The Time Value Of Money

4. The Time Value Of Money. Introduction. This chapter introduces the concepts and skills necessary to understand the time value of money and its applications. t denotes time PV 0 = principal amount at time 0 FV n = future value n time periods from time 0. Notation.

Share Presentation

Embed Code

Link

Download Presentation

brigit + Follow

Download Presentation

The Time Value Of Money

An Image/Link below is provided (as is) to download presentation Download Policy: Content on the Website is provided to you AS IS for your information and personal use and may not be sold / licensed / shared on other websites without getting consent from its author. Content is provided to you AS IS for your information and personal use only. Download presentation by click this link. While downloading, if for some reason you are not able to download a presentation, the publisher may have deleted the file from their server. During download, if you can't get a presentation, the file might be deleted by the publisher.

Presentation Transcript

- 4 The Time Value Of Money

- Introduction • This chapter introduces the concepts and skills necessary to understand the time value of money and its applications.

- tdenotes time PV0= principal amount at time 0 FVn= future value n time periods from time 0 Notation Idenotes simple interest idenotes the interest rate per period n denotes the number of periods PMT denotes cash payment (annuities only) PVdenotes the present value dollar amount Tdenotes the tax rate

- Simple Interest • Simple Interest • Interest paid on the principal sum only • I = PV0 i n • FVn =PV0 + I = PV0 + PV0 i n

- Compound Interest • Compound Interest • Interest paid on the principal and on prior interest that has not been paid or withdrawn • FV1=PV0(1+i)1 FV2=FV1(1+i)1= PV0(1+i)2 FV3 =FV2(1+i)1 = PV0(1+i)2(1+i)1 = PV0(1+i)3

- At the end of year n for a sum compounded at interest rate i is FVn = PV0(1 + i)n Formula See Figure 4.1. In Table I in the text, (FVIFi,n) shows the future value of $1 invested for n years at interest rate i: FVIFi,n = (1 + i)n Table I When using the table, FVn = PV0(FVIFi,n) See Figure 4.2. Future Value of a Cash Flow

- Future Value of a Cash • FVn = PV0(1 + i)n

- Tables Have Three Variables • Interest factors (IF) • Time periods (n) • Interest rates per period (i) • If you know any two, you can solve algebraically for the third variable.

- PV0 = FVn[1/(1+i)n]Formula PVIFi, n = [1/(1+i)n]Table II PV0 = FVn(PVIFi, n)Table II See Figure 4.3. Present Value of a Cash Flow

- Present Value of a Cash Flow • PV0 = FVn[1/(1+i)n]

- What is the PV of $100 one year from now with 12 percent (annual) interest compounded monthly? Example Using Formula PV0 = $100 1/(1 + .12/12)(12 1) = $100 1/(1.126825) = $100 (.88744923) = $ 88.74

- Example Using Table II • PV0 = FVn(PVIFi, n) = $100(.887)From Table II = $ 88.70

- Annuity • A series of equal dollar CFs for a specified number of periods • Ordinary annuity is where the CFs occur at the end of each period. • Annuity due is where the CFs occur at the beginning of each period.

- Future Value of an OrdinaryAnnuity • Formula for IF • FVANn = PMT(FVIFAi, n)Table III

- Future Value of an OrdinaryAnnuity • Suppose Ms. Jefferson receives a three-year ordinary annuity of $1,000 per year and deposits the money in a savings account at the end of each year. The account earns interest at a rate of 6% compounded annually. How much will her account be worth at the end of the three-year period?

- Future Value of an OrdinaryAnnuity • See Figure 4.6. • FVAN3= PMT(FVIFA0.06, 3) = $1,000(3.184) = $3,184

- Present Value of an Ordinary Annuity • Formula • PVAN0 = PMT(PVIFAi, n)Table IV

- Present Value of an Ordinary Annuity • What is the present value of an ordinary $1,000 annuity received at the end of each year for five years discounted at a 6% rate? • See Figure 4.8. • PVAN0 = PMT(PVIFA0.06, 5) = $1,000(4.212) = $4,212

- Annuity Due • Future Value of an Annuity Due • FVANDn = PMT(FVIFAi, n)(1 + i) Table III • Present Value of an Annuity Due • PVAND0 = PMT(PVIFAi, n)(1 + i) Table IV

- Annuity Due • Consider the case of Jefferson cited earlier. If she deposits $1,000 in a savings account at the beginning of each year for the next three years and the account earns 6% interest, compounded annually, how much will be in the account at the end of three years? • See Figure 4.7. • FVAND3 = PMT(FVIFA0.06, 3)(1 + 0.06) = $1,000(3.375) = $3,375

- Annuity Due • Consider the case of a five-year annuity of $1,000 each year, discounted at 6% interest rate. What is the present value of this annuity if each payment is received at the beginning of each year? • See Figure 4.9. • PVAND0 = PMT(PVIFA0.06, 5)(1 + 0.06) = $1,000(4.465) = $4,465

- Other Important Formulas • Sinking Fund • PMT = FVANn (FVIFAi, n)Table III • Payments on a Loan • PMT = PVAN0 (PVIFAi, n)Table IV • Present Value of a Perpetuity • PVPER0 = PMT i

- Example: Sinking FundProblem • Suppose the Omega Graphics Company wishes to set aside an equal, annual, end-of-year amount in a “sinking fund account” earning 10% per annum over the next five years. The firm wants to have $5 million in the account at the end of five years to retire (pay off) $5 million in outstanding bonds. How much must be deposited in the account at the end of each year?

- Solution Based on Table III • $5,000,000 = PMT(FVIFA0.10, 5) = PMT(6.105) PMT = $819,001

- Solution Based on the Financial Calculator • 1. 5,000,000 → FV • 2. 10 → %i • 3. 5 → N • 4. Compute • 5. PMT (= -818,987.40)

- Example: Payments on a Loan • Suppose you borrowed $10,000 from the ICBC. The loan is for a period of four years at an interest rate of 10%. It requires that you make four equal, annual, end-of-year payments that include both principal and interest on the outstanding balance.

- Solution Based on Table IV • PMT = PVAN0 (PVIFAi, n) = $10,000 (PVIFA0.10,4) = $10,000 3.170 = $3,155

- Solution Based on the Financial Calculator • 1. 10,000 → PV • 2. 10 → %i • 3. 4 → N • 4. Compute • 5. PMT (= -3,154.71)

- Present Value of a Perpetuity • Assume that Kansas City Power & Light series E preferred stock promises payments of $4.50 per year forever and that an investor requires a 10% rate of return on this type of investment. How much would the investor be willing to pay for this security? • PVPER0 = PMT i PVPER0 = $4.50 10% = $45

- Present Value of an Uneven Payment Stream • Algebraically, the present value of an uneven payment stream can be represented as • See Figure 4.10.

- Present Value of Deferred Annuities • Suppose that you wish to provide for the college education of your daughter. She will begin college five years from now, and you wish to have $15,000 available for her at the beginning of each year in college. How much must be invested today at a 12% annual rate of return in order to provide the four-year, $15,000 annuity for your daughter? • See Figure 4.11.

- Solution Based on Tables II and III • First step: calculate the present value of the four-year (ordinary) annuity PVAN4 = $15,000(PVIFA0.12, 4) = $15,000(3.037) = $45,555 • Second step: calculate the present value of the (ordinary) annuity PVAN0 = PVAN4(PVIF0.12, 4) = $45,555(0.636) = $28,973

- Solution Based on the Financial Calculator • 1. 15,000 → PMT • 2. 12 → %i • 3. 4 → N • 4. Compute • 5. PV (= -45,560) • 6. 45,560 → FV • 7. 12 → %i • 8. 4 → N • 9. Compute • 10. PV (= -28,954)

- Interest Compounded More Frequently Than Once Per Year • Suppose: • m = # of times interest is compounded per year • n = # of years Future Value Present Value

- Compounding and Effective Rates • Rate of interest per compounding period • Effective annual rate of interest

- Compounding and Effective Rates • Suppose a bank offers you a loan an annual nominal interest rate of 12% compounded quarterly. What effective annual interest rate is the bank charging you?

- Example • Mr. Moore is 45 years old today (Dec. 31) and is beginning to plan for his retirement. He wants to set aside an equal amount at the end of each of the next 20 years so that he can retire at age 65. He expects to live to the maximum age of 85 and wants to be able to withdraw $25,000 per year from the account on his 66th through 85th birthdays.

- Example • The account is expected to earn 10 percent per annum for the entire period of time. Determine the size of the annual deposits that must be made by Mr. Moore.

- Solution Based on Tables III and IV • PVAN = PMT(PVIFA0.10,20) = $25,000(8.514) = $212,850 (needed on 65th birthday) • $212,850 = PMT(FVIFA0.10,20) = PMT(57.275) PMT = $3,716.28

- Solution Based on the Financial Calculator • 1. 25,000 → PMT • 2. 10 → %i • 3. 20 → N • 4. Compute • 5. PV (= -212,839) • 6. 212,839 → FV • 7. 10 → %i • 8. 20 → N • 9. Compute • 10. PMT (= -3,716.08)

- Example • You sold 1000 shares of stock today for $80.515 per share that you paid $50 for 5 years ago. Determine the average annual rate of return on your investment, assuming the stock paid no dividends.

- Solution Based on Table II • PV0 = FVn(PVIFi, n); n = 5; PV0 = $50; FV5 = $80.515 $50 = $80.515(PVIFi, 5) (PVIFi, 5) = 0.621; Therefore i = 10% from Table II.

- Example • The Texas lottery agrees to pay the winner $500,000 at the end of each year for the next 20 years. What is the future value of this lottery if you plan to put each payment in an account earning 12 percent?

- Solution Based on Table III • FVAN20 = PMT(FVIFAi, n) = $500,000(FVIFA0.12, 20) = $500,000(72.052) = $36,026,000

- Solution Based on the Financial Calculator • 1. -500,000 → PMT • 2. 12 → %i • 3. 20 → N • 4. Compute • 5. FV (= 36,026,221.22)

- Example • Your firm has just leased a $32,000 BMW for you. The lease requires five beginning of the year payments that will fully amortize the cost of the car. What is the amount of the payments if the interest rate is 10 percent?

- Solution Based on Table IV • PVAND0 = PMT(PVIFAi, n)(1+i) $32,000 = PMT(PVIFA0.10, 5)(1+10%) $32,000 = PMT(3.791)(1.10) PMT = $7,673.68

- Solution Based on the Financial Calculator • 1. 32,000 → PV • 2. 10 → %i • 3. 5 → N • 4. Compute • 5. PMT (= -8,441.52) • 6. -8,441.52 1.10 = -7,674.11

The Time Value of Money

The Time Value of Money In order to work the problems in this module, the user should have the use of a business calculator such as the Hewlett Packard 17BII.

1.23k views • 49 slides

The Time Value of Money

The Time Value of Money Mike Shaffer April 15 th , 2005 FIN 191 Learning Objectives Understand the concept of the time value of money. Be able to determine the time value of money: Present Value. Future Value. Present Value of an Annuity. Future Value of an Annuity. Time Value of Money

575 views • 23 slides

THE TIME VALUE OF MONEY

CHAPTER 4. THE TIME VALUE OF MONEY. Chapter outline. Introduction Interest rates Future value and compounding of lump sums Compounding interest more frequently than annually Nominal and effective interest rates Present value and discounting More on present and future values

1.03k views • 38 slides

The Time Value of Money

The Time Value of Money. Economics 71a Spring 2007 Mayo, Chapter 7 Lecture notes 3.1. Goals. Compounding and Future Values Present Value Valuing an income stream Annuities Perpetuities Mixed streams Term structure again Compounding More applications. Compounding.

622 views • 45 slides

The Time Value of Money

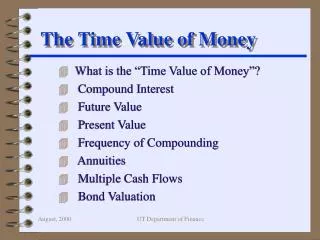

The Time Value of Money. What is the “Time Value of Money”? Compound Interest Future Value Present Value Frequency of Compounding Annuities Multiple Cash Flows Bond Valuation. Obviously, $1,000 today .

608 views • 21 slides

The Time Value of Money

The Time Value of Money. The Timeline. Suppose you are lending $ 1,000 today and the loan will be repaid in two annual payments . The timeline looks like this:

556 views • 38 slides

The Time Value of Money

Would you rather have a dollar today or a dollar next year? Present Value: The use of interest rates to compare the value of a dollar realized today with the value of a dollar realized later . $1 today @ 5% interest in savings account. The Time Value of Money. Defining Present Value.

159 views • 4 slides

The Time Value of Money

The Time Value of Money. “A Dollar Today is Worth More than a Dollar Tomorrow”. Money today will not be worth the same amount in the future Future Value: How much your money will be worth in the future. What is the Time Value of Money?. Number of Periods

169 views • 5 slides

The Time Value of Money

The Time Value of Money. Compounding and Discounting Single Sums. Today. Future. We know that receiving $1 today is worth more than $1 in the future. This is due to opportunity costs .

813 views • 71 slides

The Time Value of Money

The Time Value of Money. Learning Module. The Time Value of Money . Would you prefer to have $1 million now or $1 million 10 years from now?. Of course, we would all prefer the money now! This illustrates that there is an inherent monetary value attached to time.

422 views • 31 slides

The Time Value of Money

The Time Value of Money. Time Value of Money Concept Future and Present Values of single payments Future and Present values of periodic payments (Annuities) Present value of perpetuity Future and Present values of annuity due Annual Percentage Yield (APY). The Time Value of Money Concept.

1.95k views • 28 slides

THE TIME VALUE OF MONEY

THE TIME VALUE OF MONEY. BACK TO THE FUTURE. Future Value. Investment Interest or Yield. Yield 10%. Investment $1,000. 10. 1. x. ___. =. =. .1. =. $100 Annual Yield. 100. ___. 10. .1. .5. .08. .065. 10% =. 50% =. 8% =. 6.5% =. Compound Interest.

456 views • 33 slides

The Time Value of Money

The Time Value of Money. FIN261 Personal Finance Spring 2006 Dana Smith. Outline. Time Value of Money Future Value and Present Value Compounding and Discounting Applications of Time Value of Money Lump sum Evaluating multiple investments Compounding more frequently than annually

671 views • 40 slides

The Time Value of Money

The Time Value of Money. Chapter 5. LEARNING OBJECTIVES. 1. Explain the mechanics of compounding when invested. 2. Present value and future value. 3. Ordinary annuity and its future value. 4. An ordinary annuity and an annuity due. 5. Non-annual future or present value of a sum .

695 views • 53 slides

The Time Value Of Money

4. The Time Value Of Money. Introduction. This chapter introduces the concepts and skills necessary to understand the time value of money and its applications. Simple and Compound Interest. Simple Interest Interest paid on the principal sum only Compound Interest

463 views • 22 slides

The Time Value of Money

The Time Value of Money. What is the “Time Value of Money”? Compound Interest Future Value Present Value Frequency of Compounding Multiple Cash Flows. Obviously, $1,000 today .

310 views • 15 slides

The Time Value of Money

The Time Value of Money. Objectives. To stress that the time value of money is an integral part of financial decision making. To discuss compounding techniques To discuss discounting techniques. Future Value.

268 views • 17 slides

The Time value of money

The Time value of money. Aswath Damodaran. Intuition Behind Present Value. There are three reasons why a dollar tomorrow is worth less than a dollar today

383 views • 36 slides

The Time Value of Money

Chapter F8. The Time Value of Money. Electronic Presentation by Douglas Cloud Pepperdine University. Objectives. 1. Define future and present value. 2. Determine the future value of a single amount invested at the present time. 3. Determine the future value of an annuity.

795 views • 78 slides

The Time Value of Money

The Time Value of Money. Lecture 4. Learning Objectives. Understand what is meant by “the time value of money.” Understand the relationship between present and future value.

368 views • 33 slides